A Feature Of The Current Monetary System Is That

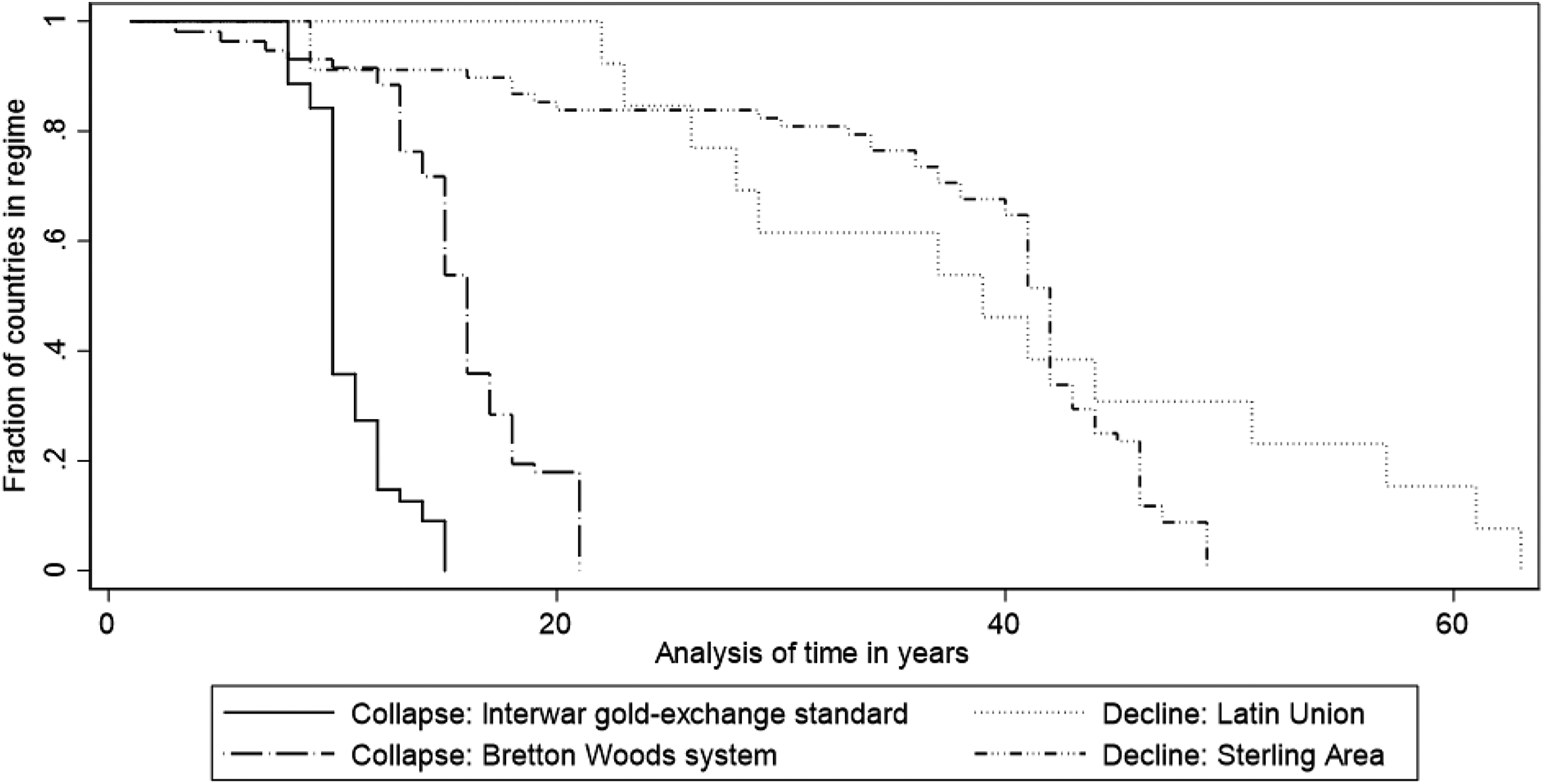

A feature of the current monetary system is that. Nominal rigidities under either a gold-exchange standard or a system of floating exchange rates liquidity preferences and network effects fiscal capacity currency of pricing endogenous reputation and private issuance. It is free from volatile movements in exchange rates. The basis of any monetary system is a defined money commodity that serves as a universal.

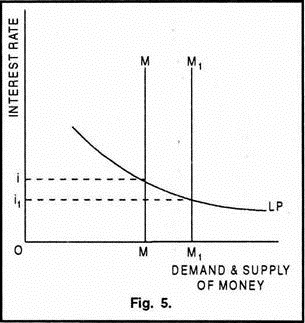

Lowering of interest rates to near-zero levels to spur investment. As on 31 March 2003 the total M 1 in India was Rs472827 crores and M 3 was Rs 1725222 crores. INTERNATIONAL MONETARY SYSTEM DEFINITION International Monetary System is part of the institutional framework that binds national economies such a system permits producers to specialize in those goods for which they have a comparative advantage and serves to seek profitable investment opportunities on a global basis.

The inputoutput table and inputoutput method have been widely used to understand complex economic structures and are often used in cross-disciplinary research between economics and other disciplines such as analysis of embodied energy carbon footprints the waterfood nexus etc. A country will peg or fix the value of its currency TO that of another major currency. 5311 The era of bimetallism.

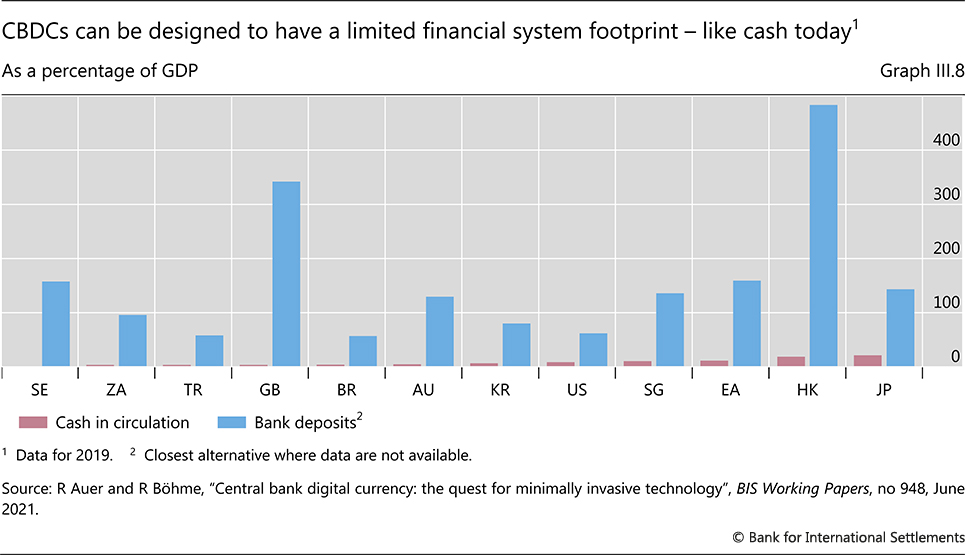

China 32 trillion more than 25 of its GDP Japan 125 trillion 30. The following article is from The Great Soviet Encyclopedia 1979. Participants to the system and have a stake in its functioning.

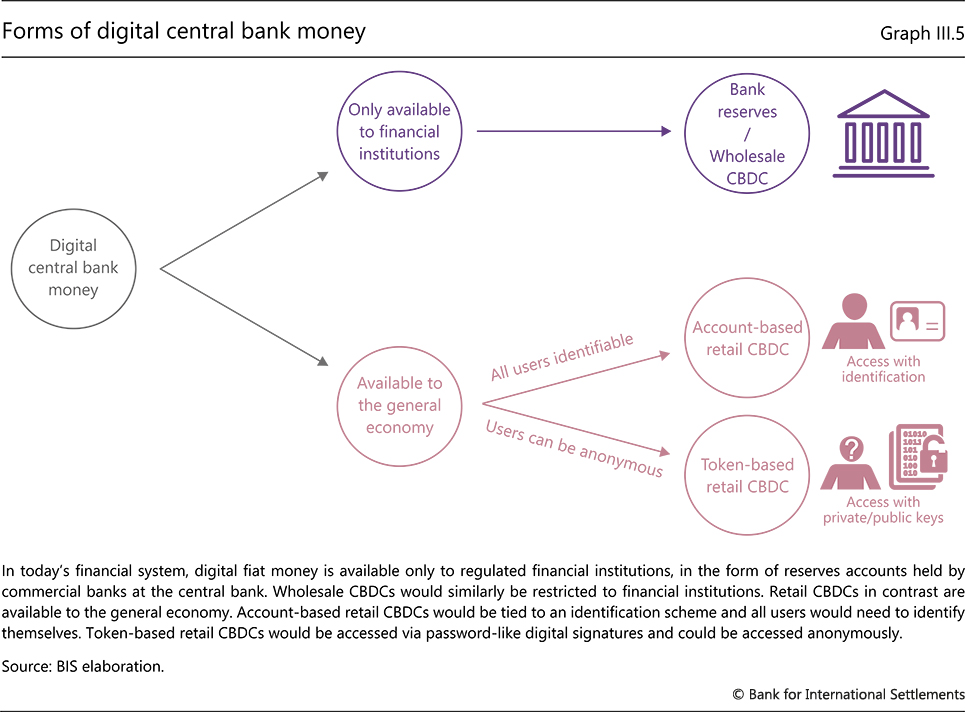

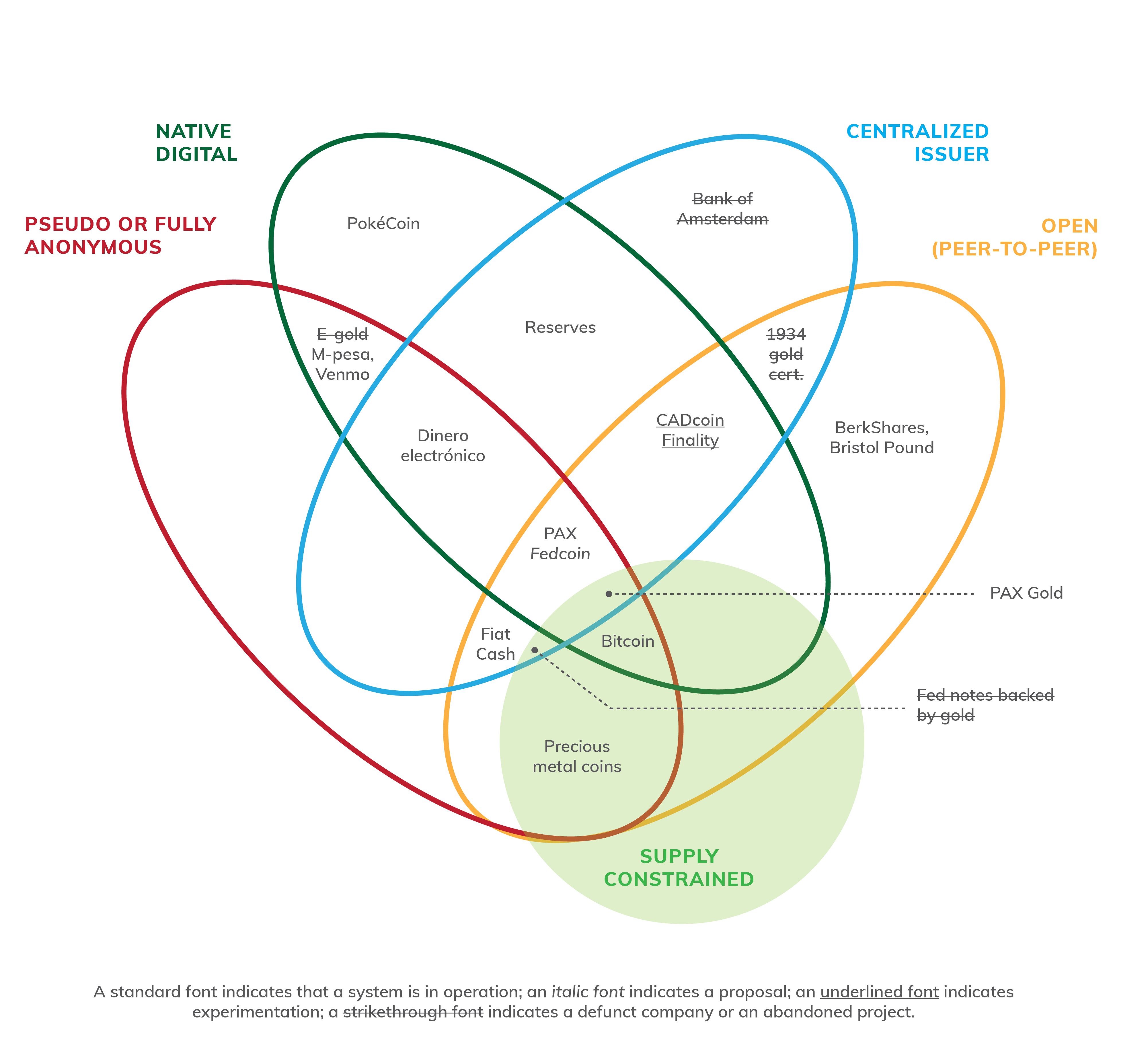

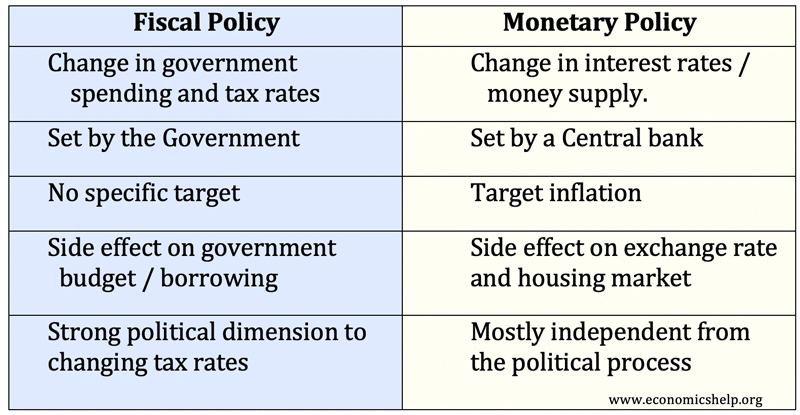

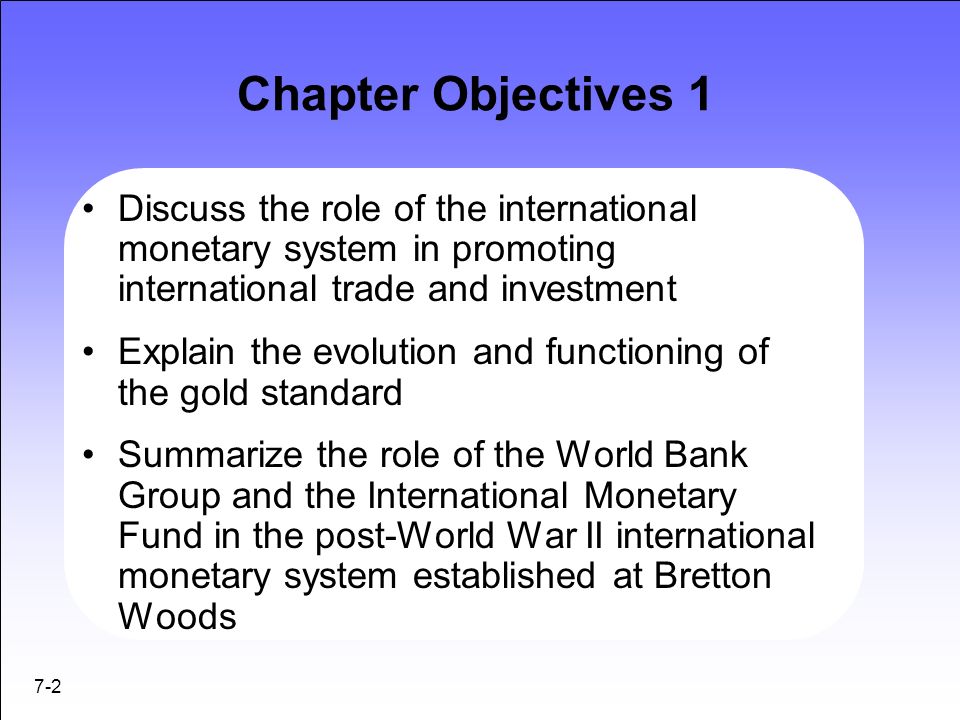

There are three common types of monetary systems commodity money commodity-based money and fiat money. Which of the following was a key feature of the South Korean agreement with the IMF following the rescue deal in 1997. The international monetary system provides the institutional framework for determining the rules and procedures for international payments determination of exchange rates and movement of capital.

A country will fix currency AGAINST another currency. Since 1973 the amount of intervention by national monetary authorities has not declined. The nominal variable is an intermediate target as its major purpose is to promote price stability by pinning down inflation expectations directly through its constraint feature.

A fixed exchange rate stabilizes the value of one currency vis-à-vis another and makes trade and investment easier. By the end of this section you will certainly be able to.

As on 31 March 2003 the total M 1 in India was Rs472827 crores and M 3 was Rs 1725222 crores.

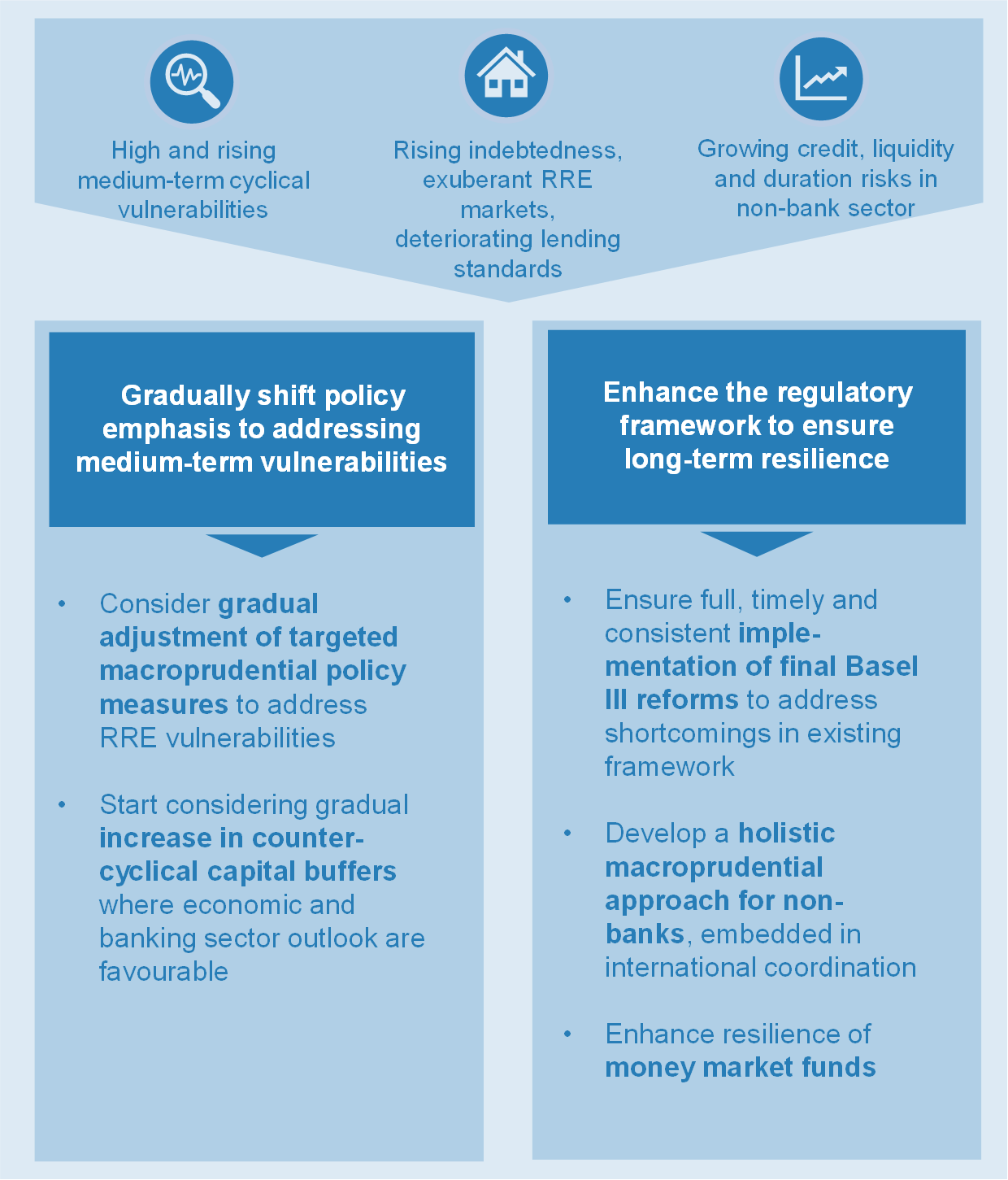

First though exchange rates are often described as freely floating determined. A country will peg or fix the value of its currency TO that of another major currency. The external features of Indias present monetary system are the following. It is free from volatile movements in exchange rates. INTERNATIONAL MONETARY SYSTEM DEFINITION International Monetary System is part of the institutional framework that binds national economies such a system permits producers to specialize in those goods for which they have a comparative advantage and serves to seek profitable investment opportunities on a global basis. Use of instruments such as the forward market and swaps has decreased since the breakdown of the Bretton Woods system. Our modern monetary system has its roots in the early 1800s. While the current system comprises three currency blocs at least one the Chinese RMB and may be other additional systemic currencies will emerge in the future. First though exchange rates are often described as freely floating determined.

M 3 consists of M 1 plus time deposits with banks and is also known as aggregate monetary resources. It is free from volatile movements in exchange rates. It might be outdated or ideologically biased. In the current system money is intrinsically useless. While the current system comprises three currency blocs at least one the Chinese RMB and may be other additional systemic currencies will emerge in the future. As on 31 March 2003 the total M 1 in India was Rs472827 crores and M 3 was Rs 1725222 crores. The present monetary system lacks the volatile movements in exchange rates that existed in a fixed exchange rate system.

/what-is-monetary-policy-objectives-types-and-tools-3305867-v4-5b6888c846e0fb002546b942.png)

Post a Comment for "A Feature Of The Current Monetary System Is That"